RBI Cuts Repo Rate by 25 bps; Raises FY26 GDP Growth to 7.3%

RBI cuts repo rate by 25 bps and boosts FY26 GDP forecast to 7.3%. What this means for home loans, EMIs, and Hyderabad real estate buyers. Full details inside.

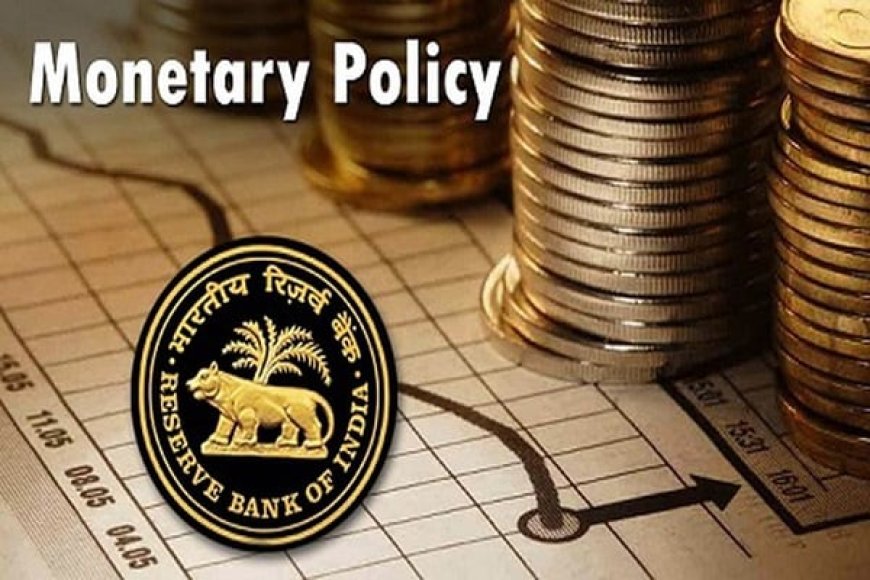

The Reserve Bank of India (RBI) on Friday, December 5, announced a 25 basis points cut in the repo rate, while maintaining a neutral stance. The decision came at the conclusion of the fifth bi-monthly Monetary Policy Committee (MPC) meeting for FY26, held from December 3 to 5 under the leadership of Governor Sanjay Malhotra. Meeting against the backdrop of robust economic momentum, historically low inflation, and the rupee trading near a record low of 90 per US dollar, the MPC voted unanimously for the rate reduction.

With this, the RBI has reduced the repo rate by a cumulative 125 basis points in four meetings since February this year. In its latest outlook, the central bank raised the FY26 GDP growth projection to 7.3%, up from 6.8% earlier, reflecting stronger economic fundamentals. Simultaneously, the FY26 CPI inflation forecast has been lowered to 2% from the previous 2.6%, signalling confidence in continued price stability.

In the October policy review, the MPC had kept the repo rate unchanged at 5.50% and retained a neutral stance, while revising GDP growth to 6.8% (from 6.5%) and trimming inflation expectations to 2.6% (from 3.1%).

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0